Financial support for social enterprises during COVID-19

By Ishita Ranjan, Project Manager at Good Finance

It’s been over a month now since we went into lockdown, and as individuals and businesses fight to adapt, we are all adjusting to life in the new normal.

It’s been over a month now since we went into lockdown, and as individuals and businesses fight to adapt, we are all adjusting to life in the new normal.

This is no different for social enterprises; some have struggled to operate and have lost entire revenue streams, others have adapted business models, traditional brick and mortar businesses operations have moved to digital delivery, and some have even managed to thrive in a changing world.

We’ve seen and heard some amazing stories. For example, Creative Optimistic Visions, who work to positively influence and support people who are vulnerable to victimisation and abuse, have moved to online classes to ensure they can keep delivering. The Good Loaf, a social enterprise bakery, has pivoted to a click and collect delivery service, and Oddbox, a fruit and veg delivery service, has expanded their catchment area for deliveries. From providing PPE, to keeping essential services going, to ensuring basic good reach at risk groups, social enterprises are making their mark on the new normal.

However, many social enterprises and charities are also struggling to survive, whether that’s due to significant drops in revenue, furloughed work forces or uncertainties about the future of their business model. Whatever position you’re in, it’s important to understand some of the key areas of financial support that are in place.

Social Investment

Grants will often be the type of money most needed at the moment, however social investment could be an option when you:

- Need bridging finance: where it’s clear where the repayment will come from

- Are pivoting your business model: when you have a good business plan that may have additional risk in delivery

- Are operating business as usual: where revenue streams appear resilient or unaffected and you are delivering your plans pre-crisis

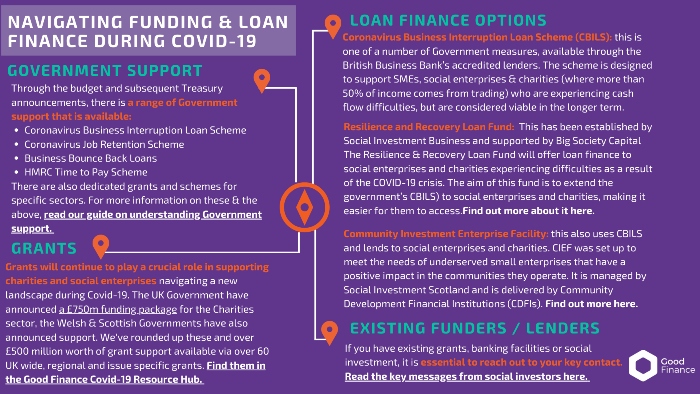

In light of the Covid-19 crisis, social investors are looking at a number of options to help the sector, including exploring new funding and adjusting existing funding. Here’s a few ways of finding out more:

- Learn about new emergency finance options being offered by social investors to extend the Government’s Coronavirus Business Interruption Loan Scheme (CBILS) to social enterprises, making it easier for them to access. This includes the Resilience and Recovery Loan Fund, specifically aimed at social enterprises and charities, as well as the Community Investment Enterprise Facility, which is aimed at small enterprises that have a positive impact in their communities.

- Use Good Finance’s investor directory to explore which social investors are providing emergency finance and are open to new investees.

- Read more about how social investors are responding and their key messages in this open letter.

Grants

For many organisations, grants will continue to play a crucial role in supporting them during this time.

- When repayable finance isn’t the answer, this blog post with 10 tips for fundraising during a crisis may be helpful

- Good Finance has rounded up UK wide, regional and sector specific grants

- Pioneers Post has a list on social enterprise funding available on an international scale

Government Support

Through the budget and subsequent Treasury announcements, there is a range of Government support that is available including:

- Coronavirus Job Retention Scheme: HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month

- Business Bounce Back Loans: will help small and medium-sized businesses to borrow between £2,000 and £50,000

- HMRC Time to Pay Scheme: because of Coronavirus you may be able to delay (defer) some tax payments without paying a penalty

- There are also several dedicated grants and schemes for specific sectors or issues

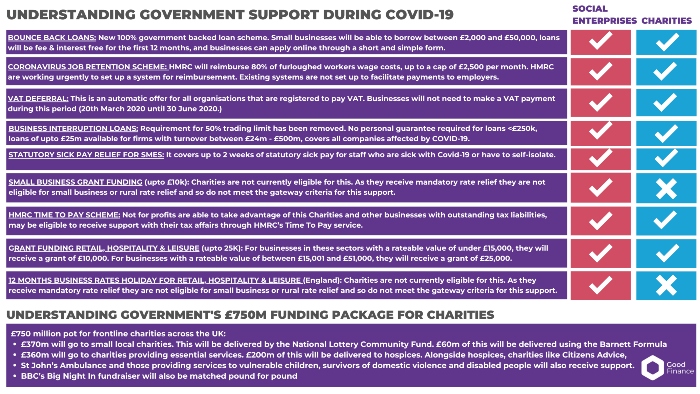

The below cribsheet explains all the various types of support, as well as what charities and social enterprises can access.

If you want to find out more on any of the above types of financial support, visit the Good Finance COVID-19 Resource Hub or Tweet @GoodFinanceUK.