Paying workers in your social enterprise

By Shaziya Somji, Managing Director of Harris Accountancy

This is the third in a series of posts Shaziya is writing for our guest blog.

Once an organisation decides to pay individuals, it will need to consider setting up payroll in order to pay the correct income tax, national and pension contributions.

Once an organisation decides to pay individuals, it will need to consider setting up payroll in order to pay the correct income tax, national and pension contributions.

To set up payroll, the organisation must register with HMRC as an employer and submit payroll information monthly or quarterly to HMRC, along with the payment of PAYE and NIC.

Employers don’t pay the first £3,000 of employer’s National Insurance Contributions, provided certain conditions are met. From April 2020 this allowance will be restricted to employers with a NI bill less that £100K.

There are instances where an organisation can pay individuals as self-employed individuals/contractors. However, the organisation has to consider off-payroll working rules (information available on the Gov.uk website).

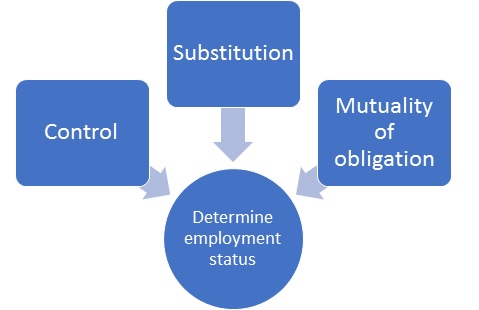

There are three main areas to consider in order to establish if an individual is employed or self-employed:

Control

Who decides what, how, when and where the worker completes the work?

Substitution

Can the worker send a substitute?

Mutuality of obligation

Is the employer obliged to offer work and is the worker obligated to accept it?

Below is an outline of the rates applicable for payroll:

- Income tax: payable from gross wages at 20% at basic rate or 40% for higher income earners.

- NIC Employee: 12% or 2% for higher income earners

- NIC Employer: 13.8% payable by the organisation

- Pension by employee: 3%

- Pension by employer: 2%

For all of the above, there are allowances – please see links in the list of references below.

Shaziya Somji is Managing Director of Harris Accountancy; an accountancy firm specialising in working with CICs and Social Enterprises. For further details or advice on tax for your organisation please book a free call via 0121 4558055 or online at www.harrisaccountancy.co.uk.

References:

- https://www.gov.uk/paye-for-employers/setting-up-payroll

- https://www.gov.uk/government/collections/employed-or-self-employed

- https://www.gov.uk/government/publications/rates-and-allowances-national-insurance-contributions/rates-and-allowances-national-insurance-contributions

- https://www.gov.uk/income-tax-rates

- http://www.thepensionsregulator.gov.uk/automatic-enrolment-earnings-threshold.aspx