Taxes explained for social enterprises

By Shaziya Somji, Managing Director of Harris Accountancy

This is the first in a series of posts Shaziya is writing for our guest blog.

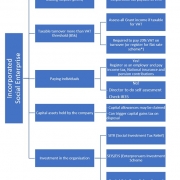

It is a common misconception that Social Enterprises are exempt from tax. For HMRC, social enterprises are treated the same as limited companies for tax purposes. On a positive note, there are some reliefs available to social enterprises and charities.

It is a common misconception that Social Enterprises are exempt from tax. For HMRC, social enterprises are treated the same as limited companies for tax purposes. On a positive note, there are some reliefs available to social enterprises and charities.

In order to help you understand the different areas, I will be writing a series of guest blogs for Social Enterprise Mark CIC, which will cover the below topics:

• Corporation tax and VAT

• Payroll taxes

• Investments reliefs

Corporation Tax

Corporation tax is payable on the annual surplus (profit) at 19%. This is normally payable nine months and one day after the accounting year end. A simple way to work out an estimate of the surplus would be as below*

*This is an estimate to enable you to budget. There would normally be adjustments and reliefs before coming to the final corporation tax figure. Also see section below on Grants.

VAT

An organisation needs to consider its ‘taxable turnover’ on a regular basis to monitor if it has reached the VAT registration threshold of £85K.

A few definitions first; taxable turnover is the income received that is considered chargeable to VAT, i.e. this excludes any income received that may be exempt or outside the scope of VAT. For example:

- Exempt supplies would be health services provided by registered doctors, education provided by an eligible body, and insurance services.

- Outside the scope of VAT are voluntary donations to a charity, postage stamps provided by Royal Mail and welfare services provided by charities.

VAT is charged at either standard (20%), reduced (5%) or zero rate (0%), and these all count towards the £85K threshold.

Here is a link to an extensive list of services and its respective VAT category.

There are options for organisations to register for VAT accounting schemes provided they meet the requirements. Click here for more information on the schemes.

From April 2019, organisations registered for VAT (compulsory registration) will need to comply with the HMRC new system of MTD (Making Tax Digital), which requires documentation to be held digitally and VAT returns to be submitted to HMRC electronically. For this reason, it will be advisable for organisations to use software compatible with HMRC Application Programming Interface (API) for book-keeping. (More details can be found in VAT Notice 700/22). Software like QuickBooks are compatible with MTD.

Grants received

Grants received by a social enterprise are NOT always exempt from corporation tax and VAT. It depends on the nature of service and the agreements in place. Here is a link to an article explaining this in more detail:

https://harrisaccountancy.co.uk/2016/08/grant-treatments-for-tax/

Shaziya Somji is Managing Director of Harris Accountancy; an accountancy firm specialising in working with CICs and Social Enterprises. For further details or advice on tax for your organisation please book a free call via 0121 4558055 or online at www.harrisaccountancy.co.uk.

References: